QuantShare language is a simple, complete

and fast scripting language.

It is a vector based language and contains more

than 200 build-in functions and indicators.

Example of a vector-based language: if you

type 'a = 1'.

The variable 'a' will be represented as an array of N elements

(N represent the number of bars for a specific symbol) where each element of the

array has a value of '1'.

Other examples:

c =

close;

This is the representation of the 'c'

variable.

|

10.5 |

11 |

11.2 |

11 |

10.8 |

10.5 |

10 |

10 |

10.3 |

11.2 |

The current symbol has

10 quotes (elements).

The first column represents the first bar or bar

number '0'.

If we type now: c = close + 2;

The representation of the 'c' variable will

be:

|

12.5 |

13 |

13.2 |

13 |

12.8 |

12.5 |

12 |

12 |

12.3 |

13.2 |

We added "2" to each element of

the array.

You can see these arrays at any time using the debugger tool.

(Right click on the editor).

In the next example, we will use a very

common function 'ref', this function let you refer to old or future

quotes.

c = ref (close, 1) makes the array shift by

one bar to the right.

|

NA |

10.5 |

11 |

11.2 |

11 |

10.8 |

10.5 |

10 |

10 |

10.3 |

'NA' means that the element of

the array contains no data.

A variable can be a number or a

string.

v1 = "test"; (assign the text 'test' to the

variable 'v1').

v2 = 2; (assigns the number 2 to the variable v2).

You

cannot do math calculation using both numeric and text variables.

v3 = v2 + 2; (Correct)

v3 = v2 + v1; (Not

Correct)

To concatenate two string variables or a

string and a numeric variables: use "." (Point)

v3 = "test ".v2." test";

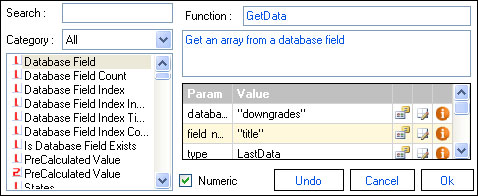

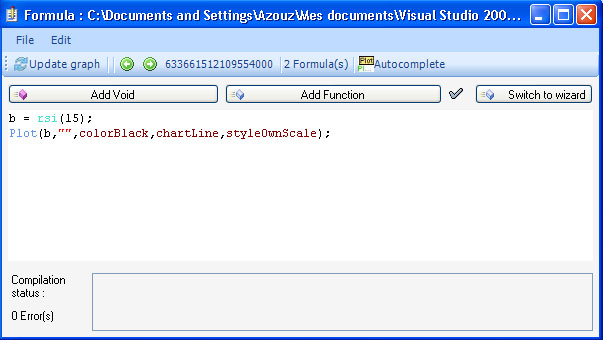

There are two types of functions:

- Void function or function that does not return a value

Example: 'Plot' function plot a time-series on a chart.

- Functions that returns a numeric or a string array

Example: 'Rsi' (Relative strength index indicator) returns a numeric

array.

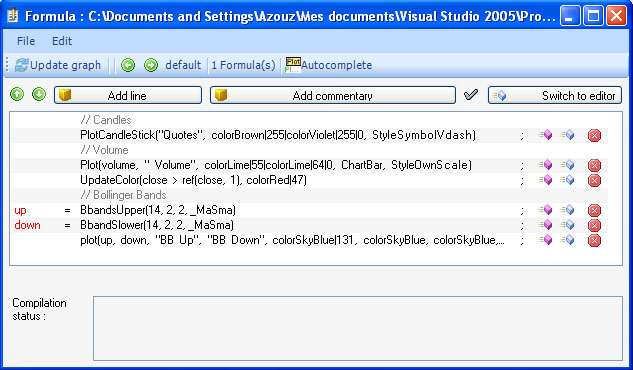

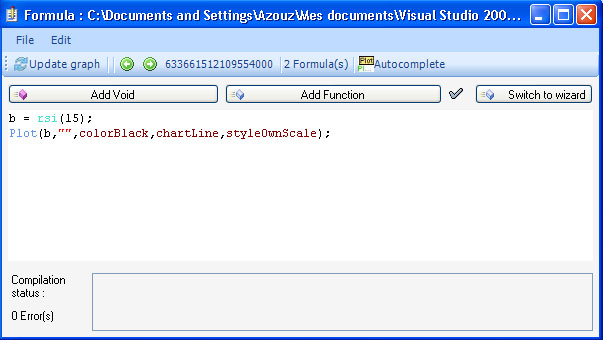

Click on 'New Chart' in the 'View' menu

to open a new chart.

Right click on the chart and click on 'Edit Formula';

the formula editor will open.

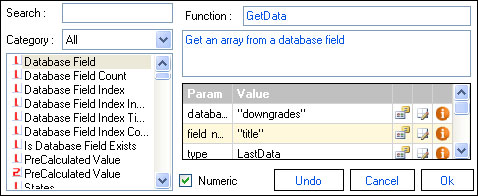

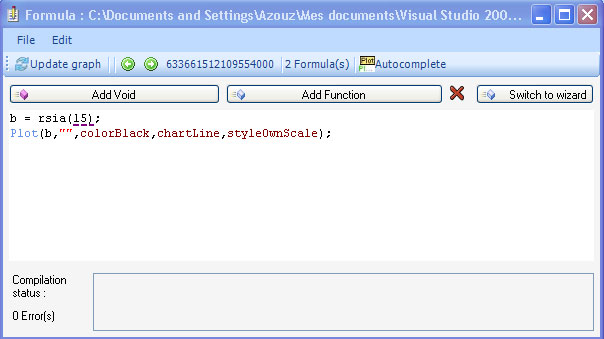

There are two ways to add a

function:

- You can add a function by typing it in the formula

editor.

- You can add a function by clicking on the 'Add void' or 'Add

function' buttons; the 'Function selector' form will

appear.

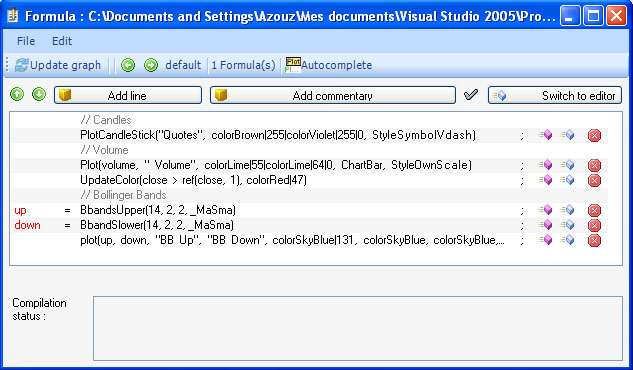

Click on 'Switch

to wizard', in the formula editor form.

There are five columns in the

wizard:

- Variable

name (Red)

- Line of

code

- Button to

add 'Void' functions

- Button to

add 'Return' functions

- Button to

remove a line

You can type '//' in the second column to

specify to the compiler that this line is a commentary line.

Switch to the

normal editor by clicking on 'Switch to editor' button.

Here is the list of the functions that let

you plot data:

- Plot: plot a vector; you can specify the color, the graph

type...

- Plot1: plot two vectors, example: higher and lower Bollinger

bands.

- PlotCandleStick: plot an OHLC

chart

- PlotFixed: plot a fixed chart, example: average performance per day

of the week or volatility for the next ten days per Relative Strength Index

values

- PlotSymbol: plot symbols above or below other graphs.

- SetMaxScale: set the Y-Axis maximum value.

- SetMinScale: set the Y-Axis minimum value.

- SetScale: set the Y-Axis maximum and minimum value.

- UpdateColor: update a graph color, on certain X-Axis

values.

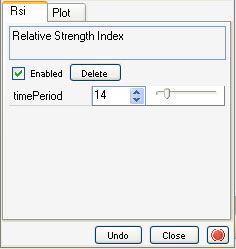

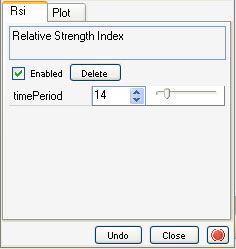

Move the mouse over a graph then right

click, a small form will appear.

Tabs shown on that form refers to functions

available in your formula.

If for example your formula is:

r = rsi

(14);

Plot(r, "RSI", colorRed, ChartLine, StyleOwnScale);

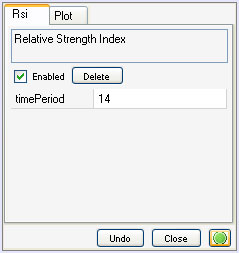

Two tabs will be available (Rsi and

Plot).

Under Rsi tab there is a cell whose name is 'timePeriod'; this cell

has a value of "14".

Click on that value, and update it using the

numeric text box or the track bar.

See how the graph updates dynamically

while you change this value.

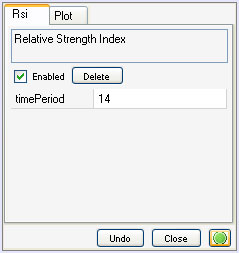

Click on the green button to make the form

stick.

In the 'Formula Editor', press on

CTRL+SPACE, a list of 'Void' functions appears.

Now type something like 'a = ', then press

on CTRL+SPACE, another list appears; this list contains all 'Return'

functions.

There is also an 'AutoComplete' button on

the 'Formula Editor'; click on that button, then type in something in the

editor, the 'AutoComplete' list now appears each time you type in a

letter.

Tooltip shows you information about

functions.

There are two

kinds of Tooltip; one that appear right after you type in '(', example: 'Plot

('.

The other Tooltip appear when you move the mouse over a

function.

The debugger displays the elements of

the variables initialized within the formula.

In the 'Formula Editor',

right click on the editor.

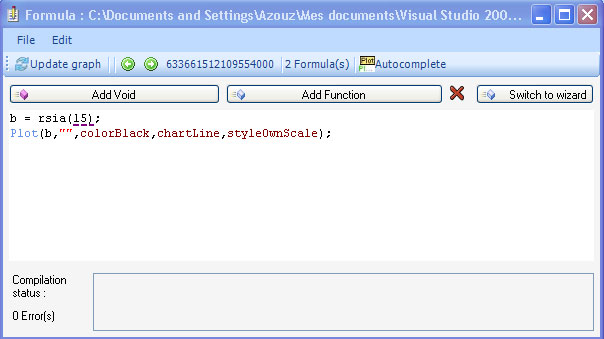

When typing a formula, an icon located at

the top shows you whether your formula syntax is correct or not, clicking on

that icon shows you the formula errors if any.

The icon is red when there is

an error otherwise it is blue.

The location of the error is underlined with

a dotted line.

After compiling the formula by clicking on

'Update Graph', the errors if any will be listed on the 'Compilation status'

text box.